The road to business recovery

In the immediate aftermath of the introduction of movement restrictions, the ONS introduced new surveys to monitor the impacts of Coronavirus (COVID-19) on the UK’s economy and society. Here Grant Fitzner reflects on the findings of the survey of impacts on UK businesses and looks at what it might mean for the UK economy in the near future.

UK businesses have clearly been hit hard by the COVID-19 pandemic. We have seen dramatic falls in output, significantly reduced consumer demand, and disrupted trade supply chains. Many companies have applied for business support, with around 8.7 million jobs furloughed through the Coronavirus Job Retention Scheme.

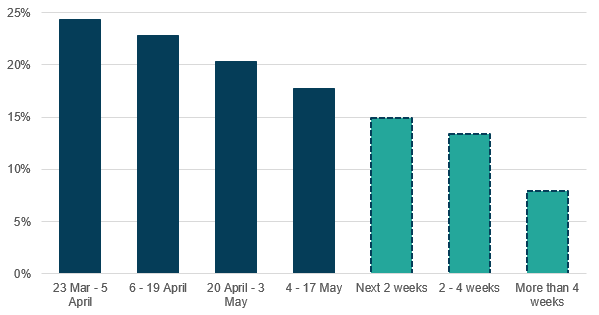

Not long after the Government announced social distancing measures and travel restrictions on 23 March our Business Impact of Coronavirus Survey (BICS) found that around one-quarter of UK businesses had temporarily closed or paused trading. Since then that proportion has gradually declined to just under a fifth (18%) in the latest period.

Figure 1: Steady decline in UK businesses that have paused trading

Percentage of all responding businesses who have temporarily closed or paused trading by survey wave, and current expectations of restarting, UK

Source: Office for National Statistics – Business Impact of Coronavirus Survey, Waves 2 to 5

Notes: 1. All percentages are a proportion of the number of businesses who responded to each particular wave; response rates can vary between waves which could impact on differences 2. Expected restarting dates are based on final Wave 5 responses from the point of completion of the questionnaire (18 May to 31 May 2020)

We asked those businesses when they intended to start trading again. One quarter said they expected to restart trading in the next four weeks, and another 30% in more than 4 weeks. If those predictions are born out, we would see the proportion of firms that have paused trading fall to under 10% of all companies – around a third of the number seen at the start of this pandemic.

However, almost half (45%) of paused businesses told us they weren’t sure when they would be able to restart trading, reflecting the high levels of uncertainty that many UK businesses continue to face. Businesses may have responded that they were not sure when they would restart trading prior to the government announcement about non-essential retailers on the 26 May 2020.

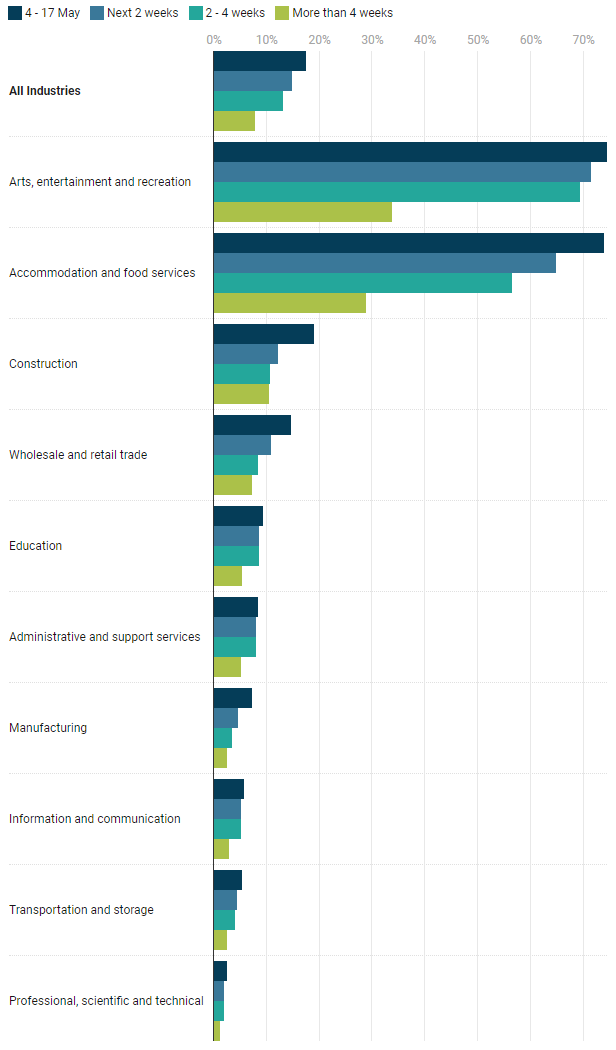

It is not a uniform picture across industry, though. These averages mask a significant divergence in business impact across different industries. In Real estate, Water & waste, and Professional, scientific and technical services fewer than 5% of businesses have paused trading. Information and communication, Transportation & storage, and Manufacturing were only a little higher.

But two industries have been particularly hard hit: around three-quarters of businesses in Accommodation & food services and Arts, entertainment & recreation, have temporarily closed. Even more worrying, the vast majority of these expect their businesses will continue to be on hold in four weeks’ time.

Two-fifths of paused businesses in Accommodation and food services, and almost half of Arts, entertainment and recreation businesses, said they were not sure when they would be able to restart.

Figure 2: A quarter of UK businesses that have paused trading expect to restart trading in the next 4 weeks

Intentions to restart trading for businesses temporarily closed or paused trading, by industry, UK, 4 May to 17 May 2020

Source: Office for National Statistics – Business Impact of Coronavirus Survey, Wave 5

Notes: 1. Aside from figures for 4-17 May 2020, these are estimates based on current business expectations, and hence could change

2. Estimates for five industries (Other Services; Mining and Quarrying; Real Estate Activities; Water Supply, Sewerage, Waste Management and Remediation Activities; Human Health and Social Work Activities) are not shown either for disclosure purposes, or because of small sample sizes, but their totals are included in ‘All industries’.

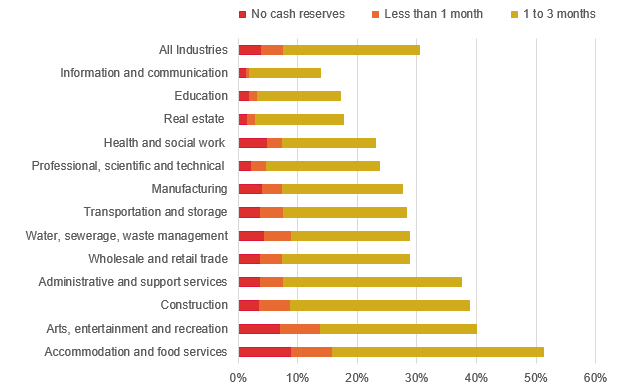

Another way of looking at the challenges facing business is when they expect to run out of cash. In the latest BICS survey we asked businesses ‘how long do you think your enterprise’s cash reserves will last?’

One in 25 responding businesses (4%) said they had no cash reserves with another 4% saying they had less than one month’s reserves. However, over a fifth (23%) said they had enough for one to three months. All up, almost one-third of UK businesses said they only had enough cash reserves to survive three months or less. Troublingly, another quarter said they were not sure how long their cash reserves would last.

Again, there is considerable variation across industries. Not surprisingly, Accommodation & food services and Arts, entertainment & recreation businesses were again most vulnerable with over half the businesses in Arts, entertainment & recreation having three months or fewer in cash reserves to rely on.

Figure 3: Almost one-third of UK businesses have cash reserves of three months or less

Percentage of all responding businesses with no enterprise cash reserves or reserves of three months or less, by industry, UK, 4 May to 17 May 2020

Source: Office for National Statistics – Business Impact of Coronavirus Survey, Wave 5

Notes: 1. Other Services and Mining and Quarrying have been removed for disclosure purposes, but their totals are included in ‘All Industries’

This points both to the high level of uncertainty and the difficult choices that many business owners, and indeed policy makers, will face in coming months.

The ONS will continue to monitor businesses’ experiences closely and will update our questionnaire to capture how they are preparing to re-open, and the steps they may need to put in place.

In more positive news, to date our business surveys have found only a very small proportion (0.5% or less per survey wave) of businesses reporting that they had permanently ceased trading. But those firms who don’t consider they’re able to restart trading any time soon, or who have fast depleting cash reserves, face an uncertain future. How they fare will have consequences not just for their business and employees, but for the wider UK economy and society.

Grant Fitzner, Chief Economist and Director of the ONS’ COVID-19 response